The independence of the Metering Function of a Utility drastically improves the…

Utilities Industry For MVNO

Utilities industry for MVNO (Mobile Virtual Network Operator) can be a nice market because it is less competitive than the Telecommunications market. Creating a specific specialization, MVNO can have a new and profitable revenue stream. MVNOs add value to the telecommunications industry, but they need to change their business model and take a more niche and targeted approach to alleviating the incredibly high competition in the markets in which they operate. The Utilities industry is a lucrative market that MVNOs should consider. In this article, I will explain what MVNOs are, their role in the telecommunications industry, their challenges and success factors, and the great opportunity they have, as well as the strategy for establishing a win-win partnership with Utilities.

Keywords: Mobile Virtual Network Operator, MVNO, MNO, Utilities, Sensors, IoT, Predictive Maintenance, NB-IoT, 5G.

This article is also available on my LinkedIn profile, which you can find here.

What is a Mobile Virtual Network Operator (MVNO)

A Mobile Virtual Network Operator (MVNO) is a telecommunications operator that provides mobile services without owning a licensed frequency allocation of radio spectrum and relies on the network infrastructure of a traditional Mobile Network Operator (MNO) [1].

Mobile services are delivered via licensed frequency allocation of the radio spectrum, which is a limited resource that limits the number of MNOs; however, new entrants can avoid this infrastructure constraint by simply operating as MVNOs. Typically, an MVNO does not own the wireless network infrastructure from which it provides services to its customers. Instead, it enters into a commercial agreement with the MNO to obtain wholesale access to network infrastructure at wholesale rates, after which it sets its retail prices separately. MVNOs are operators that provide the same services as MNOs but do not have access to the spectrum they use [1].

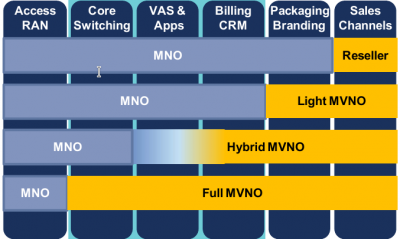

The “purity” of the MVNO is directly proportional to the number of network elements it owns and manages (the more network elements it owns/manages, the more “pure” the MVNO is) [1]. We can identify five different MVNO functional models based on this “purity” level, as shown in Figure 1: Full MVNO, Hybrid MVNO, Light MVNO, and Reseller are all options. A Full MVNO integrates all aspects of network service (design and implementation), paying only for spectrum charges to the MNO, and provides a wide range of mobile services. As a result, a “full” MVNO competes directly with the market’s MNOs in a more independent position than other MNOs [1].

Some MVNOs contract with multiple MNOs in order to make better use of their own capabilities and to supplement their portfolio with best-in-class MNOs in each area. In this Multi-MNO model, the MVNO separates the hosted service package into distinct functions and purchases them from various suppliers. Multi-MNO MVNOs enter into supply agreements with multiple MNOs but only assign one MNO to each subscriber, who receives all hosted services from that MNO. The MVNOs gain some degree of independence and operational choice under this model, and the MVNO business becomes more ‘opaque’ to the MNOs. This multi-supplier scenario strengthens MVNOs’ ability to negotiate competitive network charges [6].

MVNOs have emerged from a variety of industries (multinational consumer brands, media companies, financial institutions, or consumer electronics) and used their strong brands to enter and compete in the market by implementing strategies that differ from traditional MNOs [1]. Virgin Mobile, a subsidiary of the British multinational venture capital conglomerate Virgin Group, and Poste Mobile, a subsidiary of Gruppo Poste Italiane, were both born as postal savings and financial products in Italy. As of December 2018, there were 1,300 active MVNOs operating in 79 countries, representing more than 220 million mobile connections – or about 2.46 percent of the world’s total 8.9 billion mobile connections [5].

MVNOs Success and Challenging Factors

The success of the MVNO is not dependent on who owns and manages the network infrastructure, but rather on factors that are appealing to customers, such as tariffs, billing methods, customer service, distribution, and marketing [1]. The ten major success factors of MVNO are [6]: niche markets, innovative services, competitive low-pricing, tariff packaging, service bundling, promotions, lower cost base, favorable regulations, benefits to MNO, reach, and ubiquity.

In a mature telecommunications market, MVNOs add value by segmenting the market and providing customers with targeted services that are more efficient and provide better customer care than competitors. MVNOs are gaining significant market share, altering the telecommunications supply chain, and raising the cost of churn and subscriber acquisition in mobile markets. Because most MVNOs have focused on providing discounted services, competition has increased to the benefit of consumers [3].

Because MNOs frequently offer generic services in an attempt to serve millions of consumers and businesses with a standardized approach, MVNOs succeed by focusing on specific market segments and offering customized plans to that segment, whether they are consumers (youth, travelers) or businesses (workforce, WAN networking, IoT, etc.). Typically, MVNOs do not have a large workforce or the investment required to build and maintain networks, allowing them to focus entirely on serving customers and providing higher levels of customer satisfaction than MNOs.

According to studies, MVNOs did not differentiate their offerings from traditional MNOs and showed a clear sign of decline because the MVNO business model only works for niches or areas where the MNO is not prepared to venture or is ineffective. Virgin Mobile, for example, capitalizes on the Virgin brand and the bundled offerings of other Virgin Group companies, which no other traditional MNO can replicate [3].

MVNOs face challenges similar to traditional MNOs, such as signing an agreement with an MNO, obtaining favorable MNO terms and conditions, and managing cash flow. However, the key challenges of the MVNO, which we would explore here and propose a solution for, are technical knowledge, which requires MVNO to work with partners with deep knowledge of ICT (e.g., Core Network Architecture, IT), and customer acquisition, which, in extremely competitive markets, requires significant investment to raise brand awareness and convince customers to switch to MVNO [2].

Utilities Industry For MVNO

As previously stated, niche markets and innovative services are two of the most important success factors for MVNOs. To address the identified challenges, the MVNO should take a niche and targeted approach. The niche market is a subset of the larger market that can be defined by its own distinct needs, preferences, or identity, distinguishing it from the larger market. As a result, it would be difficult for MNOs to address niche markets as well as MVNOs.

Utilities are even more reliant on telecommunications, which are required for monitoring and controlling their networks and assets, which are typically spread across large areas on the field. As a result, Utilities companies are constantly faced with the decision of whether to purchase services from MNOs, which frequently offer rigid and expensive managed services or to develop their own telecommunications networks and application services to meet their specialized needs. Developing their own telecommunications networks, on the other hand, means losing focus on their core business, increasing capital and operating costs, and taking a long time to achieve the required level of maturity and reliability. Establishing a dedicated telecommunications division entails selecting, acquiring, implementing, and operating the appropriate and costly technologies, learning and managing specific telecommunications processes, and ensuring the resilience of their private telecommunications network, which is constantly under increasing scrutiny by governments, regulators, and investors [4].

Based on these considerations, Utilities is undeniably a niche market where MVNOs have yet to act appropriately and can instead establish a win-win and profitable partnership with Utilities, provide them with effective services, and address their needs better than MNOs.

MVNOs can meet many of Utilities’ in-house needs by leveraging their native availability of telecommunications infrastructure. In fact, most of the Utilities’ core business and operational processes rely on telecommunications technologies and infrastructures such as 2G/3G/4G/5G, NB-IoT, and LTE-M. Many remotely monitored and controlled sensors and devices are required for the operation of core Utilities processes such as generation, transmission, and distribution network management, outage and load balancing, fieldwork management, meter-to-cash, asset maintenance, and others. Remotely monitored sensors are also required for a timely response to field asset failures or for predicting their maintenance using artificial intelligence algorithms and models. These are just a few examples of how MVNOs can effectively meet the previously discussed success factors in addressing the needs of the niche market known as Utilities.

In reality, MVNOs can provide a plethora of additional services to this industry. As previously stated, one of the success factors for MVNOs is the provision of end-customer bundled services, and Utilities end-customers represent an excellent opportunity for MVNOs to expand their customer base by attracting them with products and services bundled with legacy Utilities products and services. A Utility customer, for example, can receive a free mobile alert service if his or her electricity consumption is high.

Moving into the Utilities industry market is a new venture for most MVNOs, and the complexity of this strategic action should not be underestimated. The availability of telecommunications technologies frequently leads telecom operators to believe that they can effectively provide services to Utilities, but this is not the case. Most Utilities obtain only access to their network (2G/3G/4G, NB-IoT, etc.) from telecommunications operators by purchasing SIM cards and implementing the necessary services in-house. [7] [8]

The root cause is the type, quality, and priority of resources provided by telecommunications operators to Utilities in terms of people, processes, and tools (i.e., technologies). The success of a telecommunications operator’s strategic intention to provide services to Utilities is heavily influenced by whether or not these elements are completed, customized, and addressed in the proper order. To successfully implement the strategy and execute Utilities-specific projects, each of these elements must have specific attributes that must be defined, executed, and measured. The chances of success could be improved if these elements are addressed together and with a timely focus on each of them. Unfortunately, this does not occur on a consistent basis, and as a result, the strategy’s implementation success rate is at best mediocre. Because the project involves change management, it is critical that people, processes, and tools are perfectly balanced and fully aligned. Otherwise, the project’s failure is not only unavoidable but also predictable. [7]

MVNOs seeking to enter the Utilities market should prioritize the alignment of the people, processes, and tools they provide to Utilities over intensive marketing efforts aimed at establishing a clear identity and promoting maximum awareness [7].

Conclusions

While adding value to the telecommunications industry, MVNOs should change their business model and take a more niche and targeted approach to alleviating the incredibly high competition in the markets in which they operate. Utilities are even more reliant on telecommunications, and this market can be a very profitable segment for MVNOs to keep an eye on. However, the main mistake MVNOs should avoid when entering this market is focusing their offering primarily on technologies rather than people and processes, as is common today.

References

[1] Modelling the competition of an HNO vs. an MVNO in the mobile telecommunication industry – L. Cricelli, M. Grimaldi, N. Levialdi – 2009.

[2] What challenges have MVNO? – Steve Attard – 2016.

[3] MVNO services: Policy implications for promoting MVNO diffusion – Dong-Hee Shin – 2010.

[4] A private mobile virtual network operator approach will offer new opportunities for utility companies – Ian Adkins – 2019.

[5] Mobile virtual network operator, Wikipedia, 2020.

[6] Modelling multi-MNO business for MVNOs in their evolution to LTE, VoLTE & advanced policy – Rebecca Copeland, Noel Crespi – 2015.

[7] People, Process and Tools: What is more important – the order or the mechanics? Anil Wadhwa, Neeraj Mittra, Baker Hughes.

[8] LPWAN-Based Smart Metering, Andrea Desantis, 2018

Comments (0)